|

|||

|

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

Understanding the $100,000 Mortgage Over 15 Years: Key Considerations and Common Mistakes to AvoidTaking out a mortgage is one of the most significant financial decisions many individuals will make in their lifetime. Opting for a $100,000 mortgage over a 15-year period is a decision that requires careful consideration and planning. While the appeal of owning a home is strong, there are several common mistakes that borrowers should avoid to ensure a smooth and financially sound experience. Understanding the 15-Year Mortgage: A 15-year mortgage is often touted for its potential to save homeowners money in interest payments over the life of the loan. Because the loan term is shorter than the more common 30-year mortgage, borrowers will typically enjoy a lower interest rate, leading to substantial savings. However, these benefits come with the caveat of higher monthly payments, which can strain a household's budget if not carefully planned. Common Mistake #1: Underestimating Monthly Payments: One of the most frequent pitfalls is underestimating the impact of higher monthly payments. While a $100,000 mortgage might seem manageable, the payments over 15 years can be significantly higher than a 30-year term. It's essential to calculate these payments in the context of your entire budget, considering other expenses such as utilities, insurance, and unexpected repairs. Common Mistake #2: Ignoring Total Interest Costs: Another mistake is focusing solely on the monthly payments without considering the total interest paid over the life of the loan. Although a 15-year mortgage saves money on interest compared to a 30-year loan, it's crucial to understand how much you'll pay in total. Use an amortization calculator to see the breakdown of principal versus interest payments to get a clearer picture. Making the Right Choice: When deciding if a 15-year, $100,000 mortgage is right for you, assess your financial stability and future plans. Consider your income stability, potential for salary increases, and other long-term financial goals. If you're confident in your ability to manage higher payments and are keen on building equity faster, this option could be beneficial.

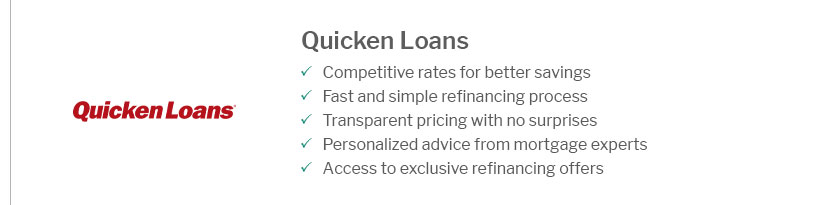

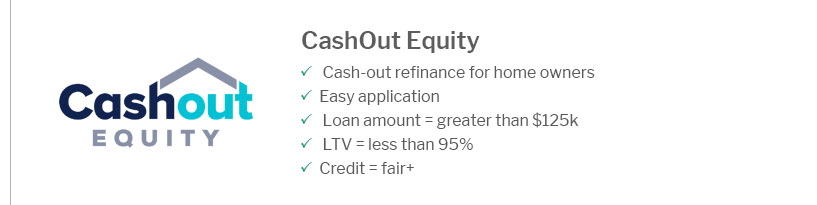

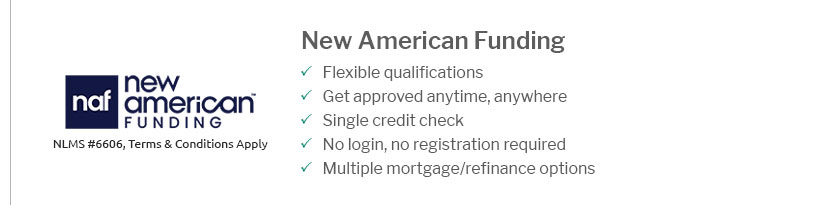

Common Mistake #3: Failing to Shop Around: Borrowers often make the mistake of not shopping around for the best interest rates and terms. Lenders offer varying rates, and a seemingly small difference can translate to significant savings. Gather multiple quotes and consider negotiating terms to get the most favorable deal. Conclusion: Choosing a $100,000 mortgage over 15 years is a commitment that requires thorough planning and consideration. By avoiding common mistakes, such as underestimating payments and ignoring total interest, and by making informed decisions through research and professional advice, you can enjoy the benefits of homeownership while maintaining financial health. https://www.scotiabank.com/ca/en/personal/mortgages/mortgage-calculator.html

What's the difference between a 30-year mortgage and a 15-year mortgage? https://www.cibc.com/en/personal-banking/mortgages/calculators/payment-calculator.html

5 years, 10 years, 15 years, 20 years, 25 years, 30 years. A shorter amortization ... https://www.mortgagerates.org.uk/repayments/100000-mortgage.html

Repayment information on a 100000 mortgage including interest paid and the total amount of the loan after 10, 15, 20 and 25 years.

|

|---|